Latest News

Hollywood’s Wild West Origins: When Moviemakers Fled East for Sunshine and Freedom

Before the glitz and glamour, Hollywood was a dusty town where pioneering filmmakers found the perfect backdrop for their silent epics, far from the constraints of the East

Crafting Gaming Videos: Elevating Highlights, Montages, and Let’s Plays

Hey there, fellow gamers! If you’ve ever been mesmerized by those epic gaming videos on YouTube or Twitch, then you know just how thrilling and captivating they can be. From

Lake Tahoe: A Gem of the Sierra Nevada

Impact of California’s Employment Laws on Businesses

Lake Tahoe: A Gem of the Sierra Nevada

Impact of California’s Employment Laws on Businesses

News

Education Reforms and Challenges In The State

Reforming Education: Driving Change Forward Education is the bedrock of society, shaping the future of our communities and economies. In our state, education reform is not just

Business

American Entrepreneurship: Driving Innovation and Business Ventures

What is Entrepreneurship? Entrepreneurship in America is a cornerstone of the economy, driven by the spirit of innovation and a culture that celebrates risk-taking and ingenuity. From

Impact of California’s Employment Laws on Businesses

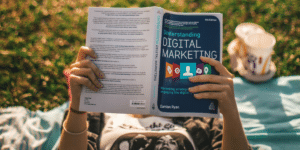

Why You Should Study Digital Marketing

Sports

Rugby: The Physicality and Camaraderie of the Sport

Finding the Right Sport That Fits Your Taste

Surf Culture: Exploring California’s Iconic Surf Spots

Riding the Mavericks Hey there, wave riders and beach bums! Let’s paddle out and dive into the vibrant world of California’s iconic surf culture. From the sandy

Rugby: The Physicality and Camaraderie of the Sport

Finding the Right Sport That Fits Your Taste

Coastal Beauty of California: Oceanfront Golf Courses

Surfing Hotspots in California: A Surfer’s Paradise

Coastal Beauty of California: Oceanfront Golf Courses

Surfing Hotspots in California: A Surfer’s Paradise

Lifestyle

Surfing Culture along the California Coast

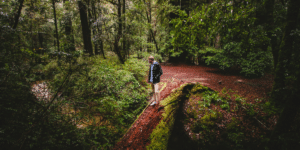

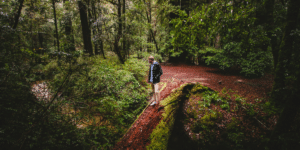

Discovering Hiking and Nature Trails in California

Yosemite National Park California isn’t just about bustling cities and stunning beaches; it’s also a paradise for outdoor enthusiasts, offering a plethora of hiking and nature trails

Surfing Culture along the California Coast

Simplify Your Life: Easy Tips for Minimalist Living

Surf Culture in California

Simplify Your Life: Easy Tips for Minimalist Living

Surf Culture in California

Opinion

California Cults: A History of Haven and Controversy

From utopian dreamers and charismatic leaders to dangerous fringe movements, California has long been fertile ground for alternative spiritual communities. LOS ANGELES, California – California,

The Power of Family Education and Empowerment: Embracing Lifelong Learning and Skill Development

Hey there, folks! Today, we’re diving into a topic that’s all about growth, connection, and empowerment: family education and lifelong learning. Whether you’re a parent

Exploring the Majestic Beauty of Redwood National and State Parks

Hey there, nature lovers and outdoor enthusiasts! If you’re on the hunt for breathtaking landscapes, towering trees, and unforgettable adventures, then look no further than

Economic Resilience: Lessons from California

Diverse Economy California, the Golden State, isn’t just famous for Hollywood, surf, and sunshine. It’s also a powerhouse when it comes to economic resilience. In

California Cults: A History of Haven and Controversy