Learning & Growth: The Importance of Skill Development and Exploration

The current pace of change necessitates an unwavering commitment to continuous learning and adaptation. The acquisition of new skills is not merely advantageous; it has become a fundamental

Not All Flowers Are Friendly: The Deception of Carnivorous Plants

When we think ‘carnivorous plants’, the image of snapping jaws (think Venus flytrap) usually springs to mind. However, the world of carnivorous plants is far more devious than that. Some

News

The Golden State Through the Literary Lens: California as Muse and Metaphor

California, with its sweeping landscapes, social complexities, and the enduring allure of reinvention, has inspired writers for generations. From Steinbeck’s Dust Bowl migrants to Didion’s incisive social

Business

Hitting the High Notes: The Magic of Car Karaoke

We’ve all been there: stuck in traffic, windows down, belting out our favorite power ballads at the top of our lungs – oblivious (or maybe not so

Why is there too many flavors in California?

Sports

Extreme Sports: Is the Rush Worth the Risk?

Extreme sports offer a thrill unlike any other. The adrenaline surge of defying gravity, mastering fear, and pushing the limits of human possibility is undeniably addictive. But

Rugby: The Physicality and Camaraderie of the Sport

Rugby: The Physicality and Camaraderie of the Sport

Lifestyle

Surfing Culture along the California Coast

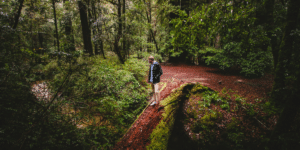

Discovering Hiking and Nature Trails in California

Yosemite National Park California isn’t just about bustling cities and stunning beaches; it’s also a paradise for outdoor enthusiasts, offering a plethora of hiking and nature trails

Surfing Culture along the California Coast

Surfing Culture along the California Coast

Simplify Your Life: Easy Tips for Minimalist Living

Simplify Your Life: Easy Tips for Minimalist Living

Surf Culture in California

Opinion

Lights, Camera, California: Your Guide to Iconic Movie and TV Locations

California’s landscapes, cityscapes, and even seemingly ordinary buildings have played starring roles in countless films and TV shows. Transform your next California road trip into

California Cults: A History of Haven and Controversy

From utopian dreamers and charismatic leaders to dangerous fringe movements, California has long been fertile ground for alternative spiritual communities. LOS ANGELES, California – California,

The Power of Family Education and Empowerment: Embracing Lifelong Learning and Skill Development

Hey there, folks! Today, we’re diving into a topic that’s all about growth, connection, and empowerment: family education and lifelong learning. Whether you’re a parent

Exploring the Majestic Beauty of Redwood National and State Parks

Hey there, nature lovers and outdoor enthusiasts! If you’re on the hunt for breathtaking landscapes, towering trees, and unforgettable adventures, then look no further than